Let’s talk about debt recovery! And the opportunities it can give or take from your business.

Every small, medium and large business needs to recover debts. It’s a part of running any business. And like everything, there are ways to do it and ways not to do it.

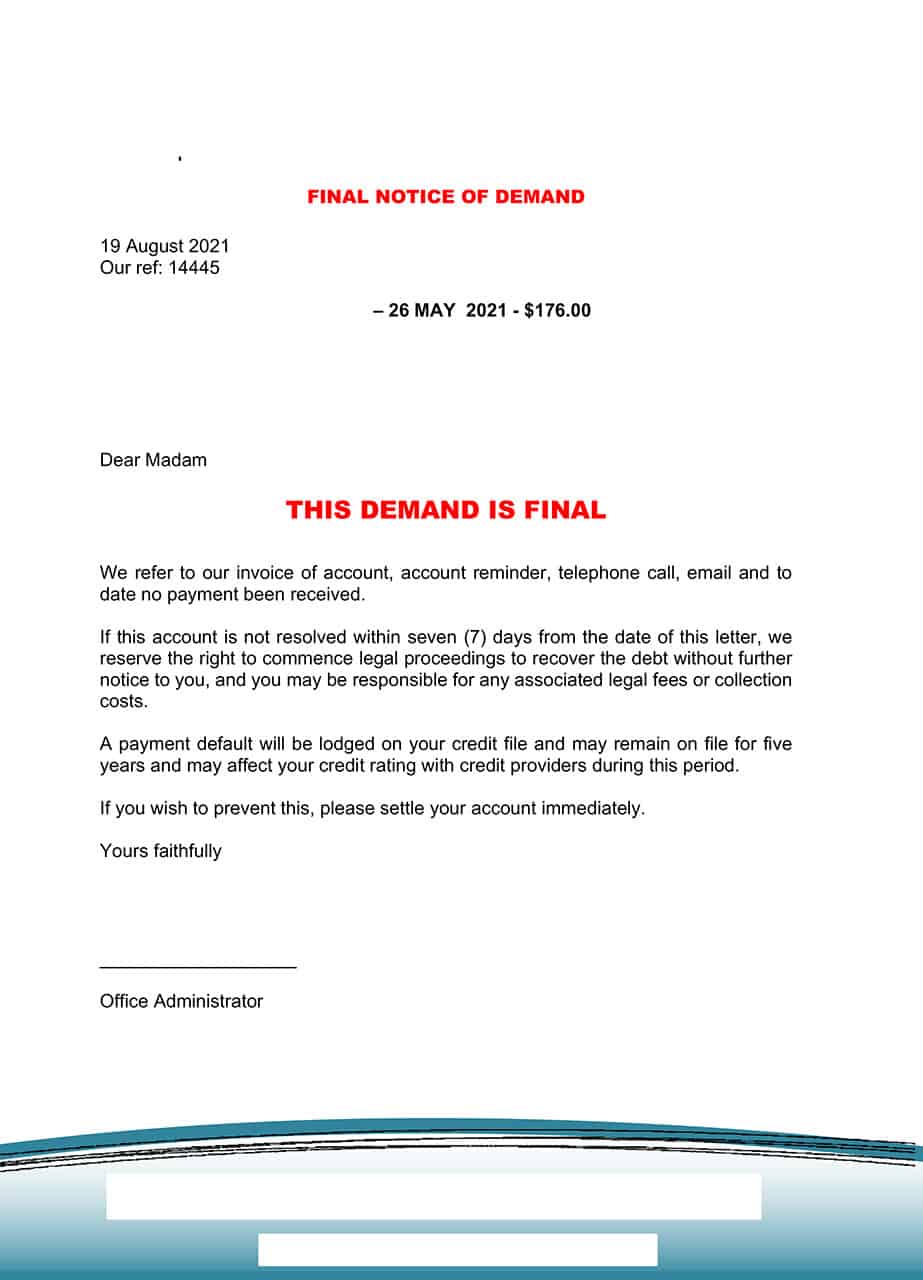

I’m going to share a story. The “final demand” letter below was sent to this company’s customer as they had not paid the outstanding invoice and it was sitting at around 60 days overdue.

The letter states “We refer to our invoice of account, account reminder, telephone call, email” which, is all pretty standard for a final demand letter. However, this company had sent 1 reminder email 2 weeks after the invoice date and that was all. The letter gives the impression that they had attempted 4 times to contact the client for payment, which they had not.

When it comes to debt recovery you MUST attempt to contact the client on more than 1 occasion, by more than one method, particularly if you are going to claim that you have.

The next thing with this “final demand” is the following sentence;

“A payment default will be lodged on your credit file and may remain on file for five years and may affect your credit rating with credit providers during this period.”

There is a lot wrong with this sentence, 2 main points being;

If you are going to make a claim, such as this, do your research! Understand the process. Don’t make claims about anything you do not understand for the sole reason of scaring the recipient.

It’s inevitable that you are going to have to chase some invoices. Sometimes multiple times. It’s a part of owning and running any business.

How you chase those invoices, says a lot about you and your business.

You can take the below approach, which is hard, rude, incorrect, misinformed and above all else, threatening.

Or, you can use it as an opportunity.An opportunity to talk to your clients. Get to know them a little better. Understand them.

I can guarantee that the company who sent this letter has lost that customer forever, a customer who was already a repeat customer to the business, a customer that will most likely now share their experience with anyone who will listen (social media is a powerful tool).

This letter is a CLEAR example of not knowing their client. If they had of actually picked up the phone, as they falsely indicated in the letter, they would have found that it was simply a miscommunication between the couple and the invoice was overlooked. Simple! Problem solved and they would have been paid sooner. Instead, they chose to be threatening and misleading.

Maybe your clients will have a bigger problem; COVID has shut their business down or they’ve lost work hours, maybe they have had a family emergency or even a death. Or, they may have simply overlooked the invoice. Never assume that they are trying to avoid payment. If you pick up the phone, 9 times out of 10 people will be upfront and honest with you. Compassion and understanding will go a long way for you in being paid, retaining that client, getting repeat business and them recommending you on social media and to friends and family.

Unfortunately, at some point, there will be a debt or two which understanding, compassion or patience won’t help you recover. If so, it is paramount that you understand the recovery process and you seek professional help. You may need to go to court to recover your debt, if that is the case, sending letters like the below, could see your case thrown out.

If you would like more information, have any questions, or would like further resources, please get in touch.